The foreign exchange market, or forex for short, is a vast and dynamic landscape for traders. But with every opportunity comes the need for careful planning and risk management. This is where a forex profit calculator steps in, acting as your personal profit prediction tool.

Demystifying the Tool: What is a Forex Profit Calculator?

A forex profit calculator is a digital tool that estimates your potential profit (or loss) on a forex trade. It factors in key variables like currency pair, trade size, entry and exit prices, and pip value.

Unveiling the Magic: How Does it Work?

Using a forex profit calculator is straightforward. Here’s a breakdown:

- Select your currency pair: Choose the forex pair you plan to trade, like EUR/USD or GBP/JPY.

- Enter your trade size: Indicate the amount of currency you want to buy or sell (lot size).

- Pick your direction: Specify whether you’re going long (buying) or short (selling) on the base currency.

- Input key prices: Enter your entry price (where you buy/sell) and your target exit price (where you plan to close the trade).

- Calculate your profit (or loss): The calculator will use these variables and the pip value to estimate your potential profit or loss.

Beyond the Basics: Advanced Features of Some Calculators

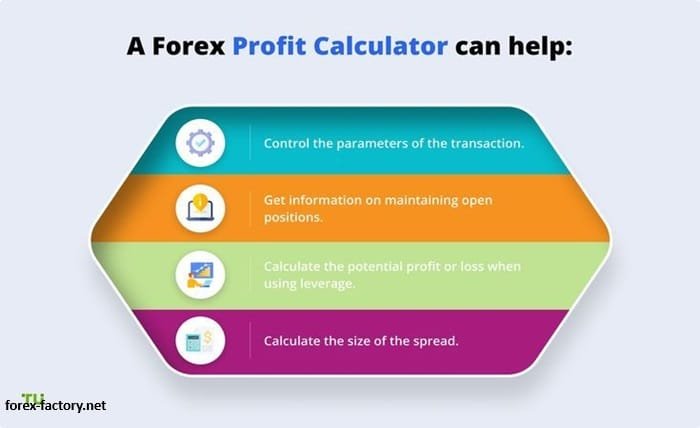

Some forex profit calculators offer additional features, like:

- Spread calculation: Estimates the spread (difference between bid and ask prices) you’ll pay on your trade.

- Commission fees: Allows you to factor in any commission fees charged by your broker.

- Margin calculator: Helps assess the margin required to open a leveraged trade.

The Power of Prediction: Why Use a Forex Profit Calculator?

Here’s why a forex profit calculator is a valuable tool:

- Planning your trades: Estimate potential profits and losses before entering a trade, promoting informed decision-making.

- Risk management: Identify potential losses before you trade, allowing you to set stop-loss orders and manage risk effectively.

- Testing strategies: Experiment with different entry and exit prices to see how they impact your potential profit.

- Building confidence: Gaining a clearer picture of potential outcomes can boost your trading confidence.

Beyond the Calculator: Additional Considerations for Success

While a forex profit calculator is a valuable tool, remember:

- Market volatility: The forex market is dynamic, so actual profits may differ from predictions.

- Fundamental analysis: Consider economic factors that can impact currency prices.

- Technical analysis: Utilize technical indicators to support your trading decisions.

- Discipline and risk management: Always prioritize responsible trading practices.

Frequently Asked Questions

Q: Are forex profit calculators free?

A: Yes, many forex profit calculators are free to use and readily available online from brokers and financial websites.

Q: How accurate are forex profit calculators?

A: The accuracy depends on the accuracy of the information you input. Remember, market fluctuations can impact actual results.

Q: What is the pip value?

A: The pip (percentage in point) is the smallest price movement in a currency pair. The pip value depends on the currency pair you’re trading.

Q: Do I need a forex profit calculator to be a successful forex trader?

A: While not essential, a forex profit calculator can be a valuable tool in your trading arsenal.

Q: What other tools should I consider using for forex trading?

A: Forex news feeds, economic calendars, and technical analysis tools can provide valuable insights alongside a forex profit calculator.

By incorporating a forex profit calculator into your trading routine, you can gain valuable insights into potential profits and losses, ultimately empowering you to make informed decisions in the dynamic world of forex trading.