Introduction:

The forex market is open for business five days a week, 24 hours a day, and is renowned for its flexibility and accessibility. To take advantage of the best trading possibilities, traders must be aware of the forex market’s operating hours. We offer a thorough how-to for navigating the different trading sessions and optimizing trading efficiency.

The Global Forex Market:

Learn about the forex market’s global reach, which spans time zones and enables traders to engage in round-the-clock trading.

Major Trading Sessions:

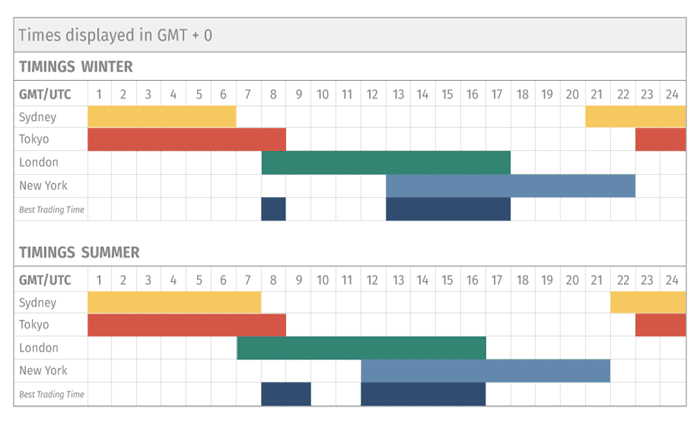

Learn about the distinctive features and trading volumes of the four main forex market trading sessions, which are Sydney, Tokyo, London, and New York.

Overlapping Sessions:

Examine the significance of trading sessions that overlap, such as the one between London and New York, which frequently has more trading activity and volatility and offers profitable trading chances.

Ideal Times to Trade:

Determine when it’s ideal to trade in the forex market by taking into account market mood, volatility, and liquidity. Then, optimize your trading techniques to maximize your profits.

Weekend Trading and Gaps:

Learn how traders can manage risk, capitalize on market fluctuations, and potentially exploit price gaps during the weekend when the forex market remains closed.

Factors Affecting Market Hours:

Identify the variables that influence forex market hours, such as central bank announcements, economic releases, and geopolitical events, and how they may affect trading circumstances.

Adapting Trading Methods:

Learn how traders may maximize their chances of success by adapting their trading methods to fit various trading sessions and market circumstances.

Conclusion

Traders must understand the forex market hours to take advantage of the best trading opportunities and maximize their profits. To succeed in trading, traders can adjust their methods to fit various market conditions by identifying the main trading sessions, overlapping times, and variables impacting market hours.

FAQs

1. Is the forex market open on weekends?

No, the forex market closes on Friday evenings (around 5 PM EST) and resumes trading the following Sunday evening.

2. Which trading session is the most volatile?

The London and New York sessions often experience the highest trading volume and potential volatility due to overlapping activity from major financial centers.

3. Do I need to trade forex 24/7?

No, you can choose specific times to trade based on your strategy and risk tolerance.

4. Can I make money trading forex during inactive sessions?

While currency movement can occur during less active sessions, trading volume and volatility might be lower, potentially impacting profit opportunities.

5. Is it always better to trade during peak activity sessions?

Not necessarily. Some traders prefer less volatile environments during off-peak sessions to implement specific strategies.